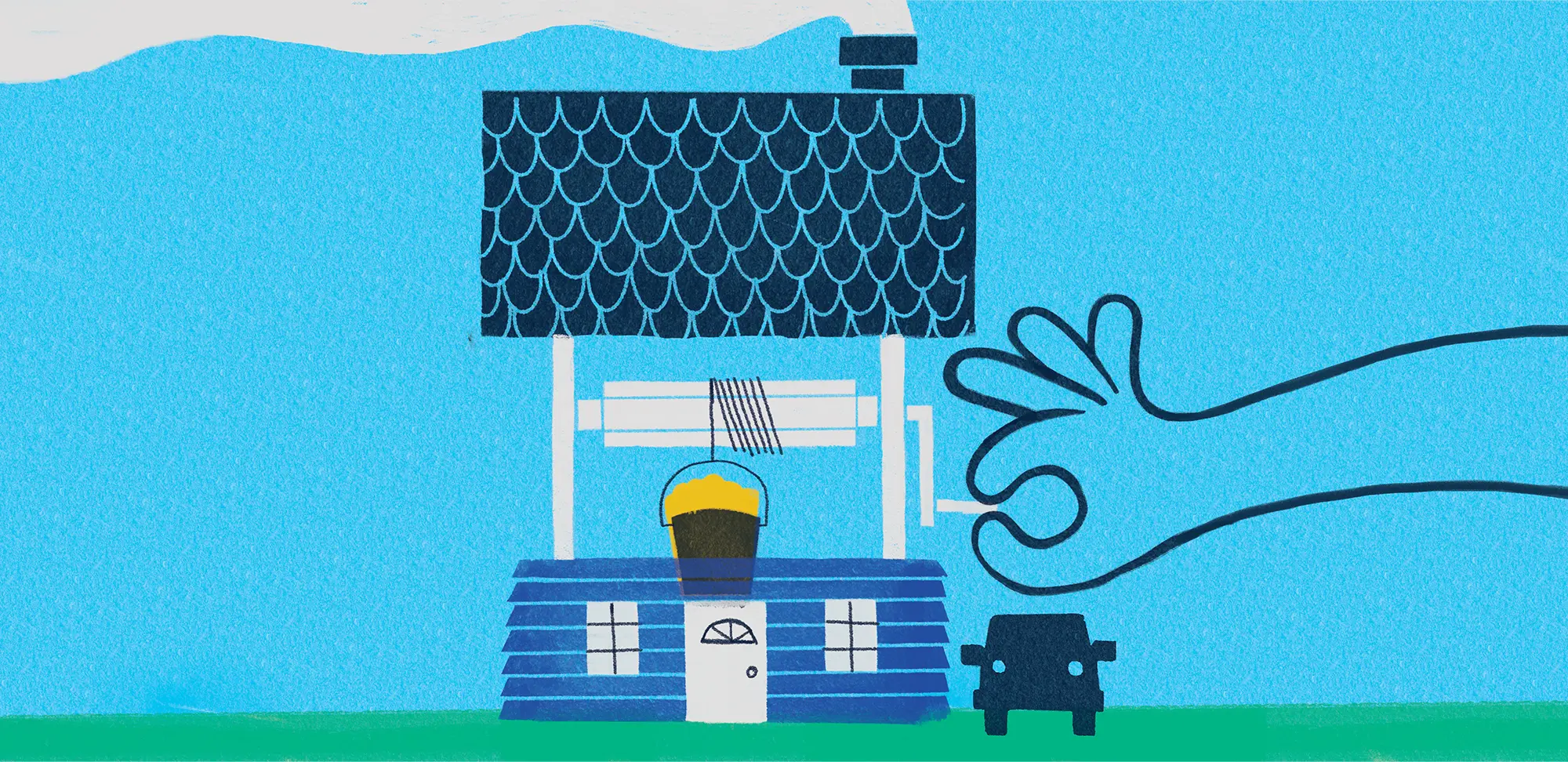

A reverse mortgage is a loan that allows you to take money from your home equity without having to sell.

The money is tax-free cash, it’s typically offered at a reasonable interest rate, monthly payments aren’t required and you can usually borrow up to 55 per cent of your home’s current value. The exact amount you can get will depend on your home’s appraised value, the lender you choose to work with and your age. Another benefit: This money doesn’t affect the old age security or guaranteed income supplement benefits you may be getting.

Many retirees turn to a reverse mortgage because they don’t want to sell their home. (When you do sell, you will have to pay the loan back.)

Not surprisingly, the longer you go without making payments, the more interest you accumulate. The result? You’ll have less equity in your home over time.

How it works

When you are approved for a reverse mortgage, you’ll need to clear up any outstanding loans, mortgages or lines of credit (including home equity lines of credit) that are secured against your home. But, in many cases, you can use the money from your reverse mortgage to pay out these other loans. When you receive the remaining funds, you can use them on anything you wish, such as paying for home repairs or improvements, helping with regular bills, covering health-care expenses or repaying debts.

You may be able to get the money from your loan as a one-time lump sum or by taking some up front and the rest over time. Ask your lender what payment options are offered for a reverse mortgage and whether there are any restrictions or fees.

Compare your options

My advice? Before you sign on the dotted line, compare the costs of the alternatives to a reverse mortgage:

- Downsizing to a smaller home

- Selling and moving to a rental (or assisted living, if applicable)

- Getting another type of loan, like a line of credit

A few things to watch out for

A reverse mortgage does have higher interest rates than a traditional mortgage, and there can be additional costs, which makes it a more expensive option for retirees. And the moment you take out a reverse mortgage, your home equity goes down and, therefore, so does your net worth, unless you use the money for investment purposes.

If leaving your home to your family is part of your estate plan, you’ll also need to consider the fact that the estate has to repay the loan with interest by a set time after you pass — and it’s possible that the estate settlement and repayment due dates might not align.

But these cons need to be weighed against the benefits, such as being able to access to your hard-earned capital and not having to move. Explore your options, crunch the numbers and talk to your financial advisor about how a reverse mortgage will impact your overall financial plans.